Annual inflation’s sharp decline from 6.7pc in september to four.6pc in october caused big joy among inventory market buyers. It means there may be a reduced prospect of in addition interest rate rises and a more danger that looser financial coverage will step by step emerge over the approaching months.

As soon as time lags have labored their manner via, interest price cuts should have a superb effect on financial boom and the inventory market. A comparable state of affairs in europe and america, in terms of falling inflation and the likelihood of extra accommodative economic policy, should boost company profitability and percentage prices globally.

Questor consequently remains unashamedly upbeat approximately the prospects for its wealth preserver portfolio. Of our initial notional funding, 20pc became allotted to shares. To date our stock holdings have declined by using 28pc on common, however now ought to benefit from an enhancing working outlook because the era of high inflation and interest fee rises abates.

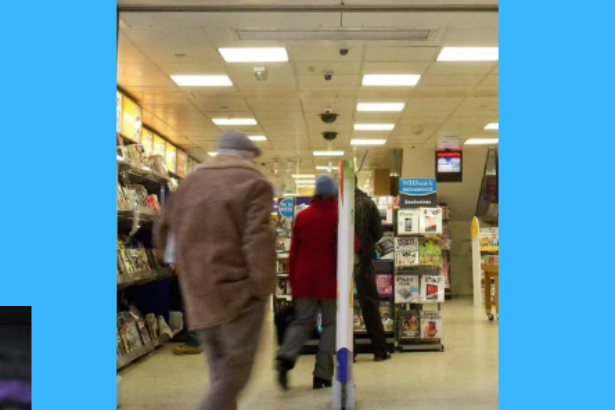

Several of our holdings are delivering sound economic overall performance whilst their proportion expenses be afflicted by weak market sentiment. Wh smith, for instance, lately launched complete-12 months results that reported a 28pc upward push in income and a 96pc increase in pre-tax profits in comparison with the preceding year.

Its journey segment, essentially stores located at airports and railway stations, turned into the catalyst for growth. It benefited from a endured upward thrust in passenger numbers and have to be in addition boosted by using a forecast return to 2019 global passenger numbers in 2024, in addition to their continued increase over the long run amid a greater sanguine monetary surroundings.